sales tax in fulton county ga 2019

Fulton Countys sales tax is 775 percent collected on all retail sales except food. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

Transportation Tax On Seven Georgia Counties Nov 2 Ballots

Personal finance personal taxes.

. Georgia has 961 cities counties and special districts that collect a local sales tax in addition to the Georgia state sales taxClick any locality for a full breakdown of local property taxes or visit our Georgia sales tax calculator to lookup local rates by zip code. 445 802 Views. What is the sales tax on food in Fulton County GA.

Helpful Links Cities of Fulton County. Depending on local municipalities the total tax rate can be as high as 9. 404-612-6440 or by mail at.

Due to renovations at the Fulton County Courthouse. What is the sales tax rate in Fulton County. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

Ad Lookup Sales Tax Rates For Free. The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. 2020 rates included for use while preparing your income tax deduction.

GEORGIA SALES AND USE TAX RATE CHART Effective January 1 2019 Code 000 The state sales and use tax rate is 4 and is included in the jurisdiction rates below. Fulton Board of Assessors Suite 1047B 141 Pryor Street SW Atlanta GA 30303. In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

The county-level sales tax rate in Fulton County is 3 and all sales in Fulton County are also subject to the 4 Georgia sales tax. The 1 MOST does not apply to sales of motor vehicles. If you need access to a database of all Georgia local sales tax rates visit the sales tax data page.

Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. This presentation outlines an update to Fulton Countys Transit Master Plan.

This rate includes any state county city and local sales taxes. This is the total of state and county sales tax rates. Other Taxes Sales Tax.

The Georgia state sales tax rate is currently 4. The current total local sales tax rate in Fulton County GA is 7750. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day.

Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. 060 Fulton Not Atlanta 775 ML E Tf 060A Fulton In Atlanta 89 ML E O mTa 061 Gilmer 7 L E S 062 Glascock 8 L E. The 2018 United States Supreme Court decision in South Dakota v.

The Fulton County Sheriffs Office month of November 2019 tax sales. Cities towns and special districts within Fulton County collect additional local sales taxes with a maximum sales tax rate in Fulton County of 89. The Fulton County Board of Assessors can be reached at.

The Georgia state sales tax rate is currently. Interactive Tax Map Unlimited Use. The Fulton County sales tax rate is 3.

The proposed short-term plan update includes 16 B in rapid transit projects across Fulton County based on the passage of HB 930 which allows for a 02-cent sales tax over 30 years 100 M in State funding allocated to GA 400 and an assumed 200 M in Federal. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. The Fulton County sales tax rate is.

As required by law the Fulton County Sheriffs office conducts its tax sale on the steps of the Fulton County Courthouse on the first Tuesday of each month beginning at 1000 AM though they occasionally skip a month. Any entity that conducts business within Georgia may be required to register for one or more tax specific identification numbers permits andor licenses. Version 1052 Download 131 MB File Size 1 File Count January 30 2019 Create Date March 25 2019 Last Updated.

If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate is 49. For TDDTTY or Georgia Relay Access. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

The December 2020 total local sales tax rate was also 7750. Georgia has a 4 sales tax and Fulton County collects an additional 26 so the minimum sales tax rate in Fulton County is 66 not including any city or special district taxes. 26 Votes The minimum combined 2020 sales tax rate for Fulton County Georgia is 89.

This table shows the total sales tax rates for all cities and towns in Fulton County including all local taxes. It usually takes 2-3 hours for them to work through the list which usually includes over 100 properties. Georgia sales tax details.

Surplus Real Estate for Sale. Fultons rate inside Atlanta is 3. This coupled with the base rate of Georgia sales tax means the effective rate is 89.

This is the total of state and county sales tax rates. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. The Georgia GA state sales tax rate is currently 4.

The latest sales tax rate for Atlanta GA. The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl which may refer to a local government divisionYou can print a 85 sales tax table hereFor tax rates in other cities see Georgia sales taxes by city and county.

Sales Taxes Up Across Area Down In Olean News Oleantimesherald Com

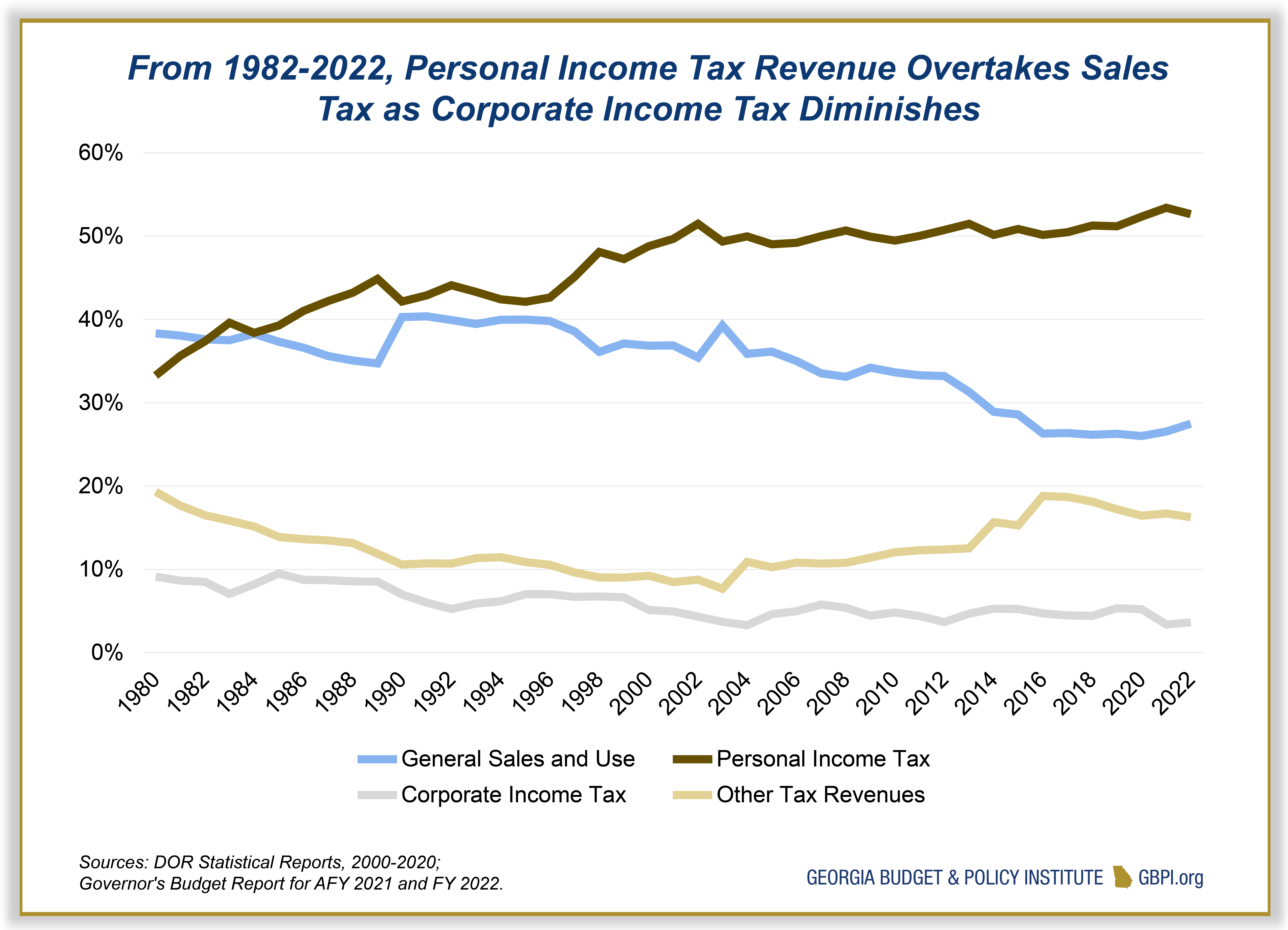

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

W Val Oveson Joins Taxometry As Senior Vice President Send2press Newswire New Technology Paradigm Shift State Tax

How To Register For A Sales Tax Permit In Georgia Taxvalet

Georgia Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

What Is The State Seal Of Georgia Learn The History Of The Ga State Seal

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Sales Taxes In The United States Wikiwand

Georgia Sales Tax Rates By City County 2022

Georgia Used Car Sales Tax Fees

Sales Taxes Up Across Area Down In Olean News Oleantimesherald Com

Tsplost And Marta Referenda Atlanta Ga

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Tsplost And Marta Referenda Atlanta Ga

Georgia S Internet Retail Tax Takes Effect Jan 1

File Sales Tax By County Webp Wikimedia Commons

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute