tennessee inheritance tax rate

This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an. Though Tennessee has no estate tax there is a federal estate tax that may apply to you if your estate is of sufficient value.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. 2016 Inheritance tax completely eliminated For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. 2012 - Inheritance Tax Changes.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. The good news is that Tennessee is not one of those six states. The schedule for the phase out is as follows for the tax rate.

What is the state of Tennessee inheritance tax rate. Also estates of nonresidents holding property in Tennessee must file Form INH 301. Up to 25 cash back Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million.

Federal Estate Tax. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. What is the state of Tennessee inheritance tax rate.

2006 - Qualified Tuition ProgramsInternal Revenue Code IRC Section 529 Plans. The taxes that other states call. The top estate tax rate is 16 percent exemption threshold.

Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. 4 of taxable income for tax years beginning January 1 2017 3 of taxable income for tax years beginning January 1 2018. It has no inheritance tax nor does it have a gift tax.

If the value of the gross estate is below. Only seven states impose and inheritance tax. Even though this is good news its not really that surprising.

What is the inheritance tax rate in Tennessee. What is the state of Tennessee inheritance tax rate. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

2013 - Online Inheritance Tax Consent to Transfer Application. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. There is a 1170 million. What is the inheritance tax rate in Tennessee.

IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside. However if the value of the estate. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident.

Year of death must file an inheritance tax return Form INH 301. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now.

Estate Tax Rates Forms For 2022 State By State Table

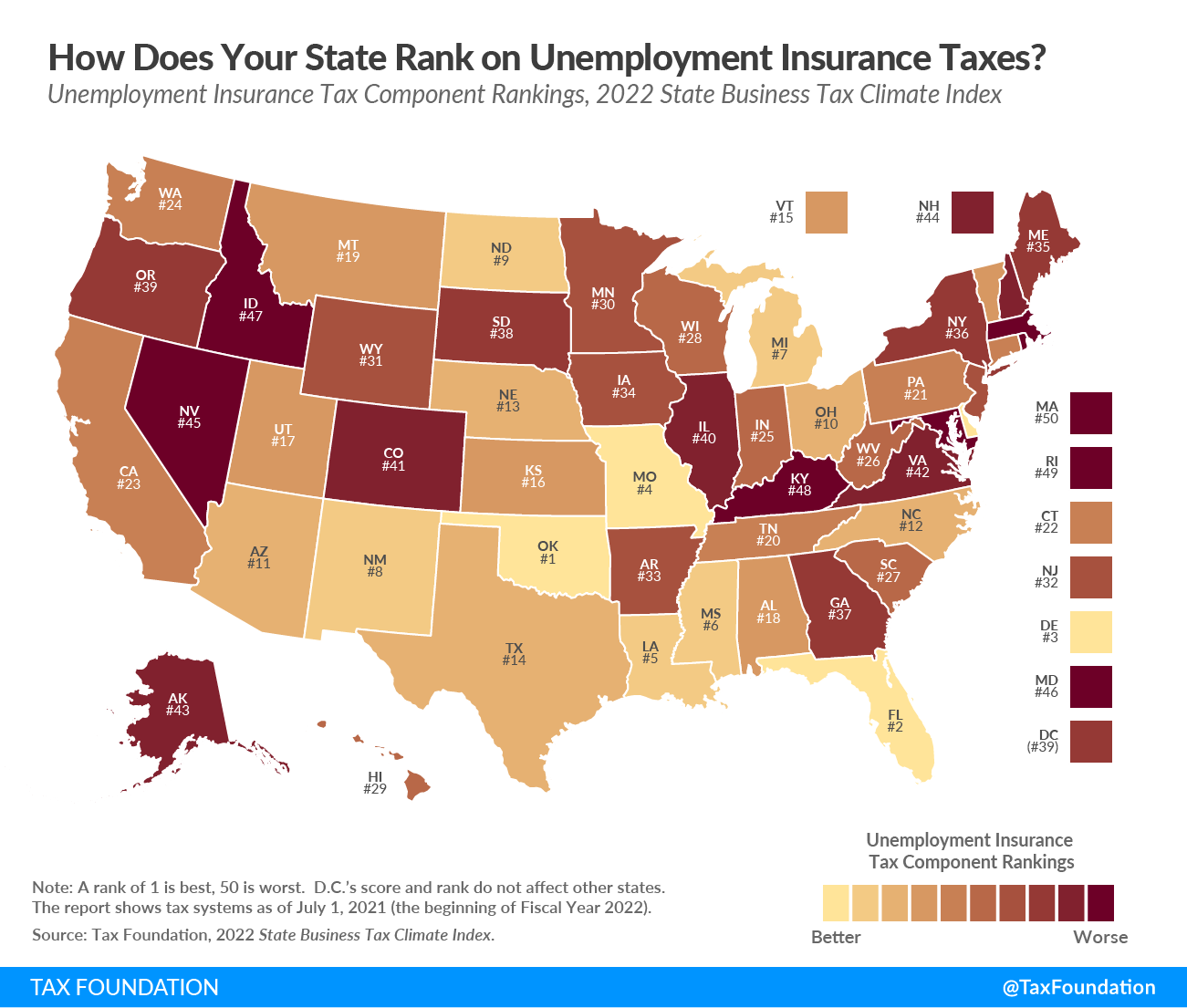

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Tennessee Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

2022 Property Taxes By State Report Propertyshark

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Estate Tax Rates Forms For 2022 State By State Table

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

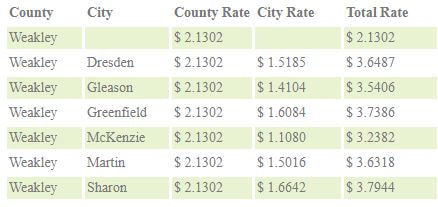

Weakley County Assessor Of Property Tax Rates

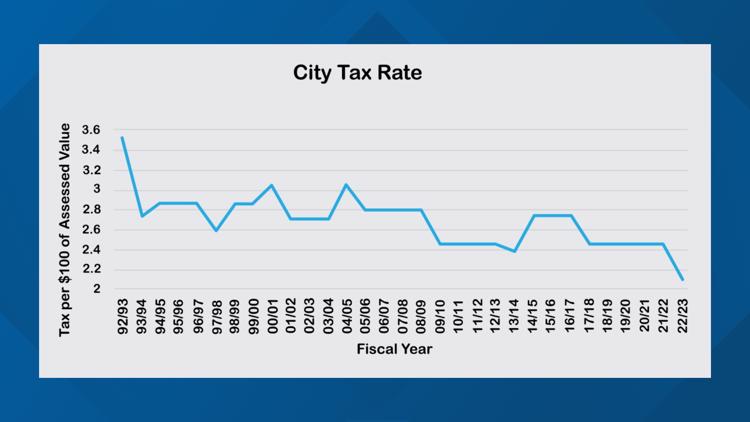

Knoxville Mayor Proposes Lowest City Tax Rate In 50 Years Wbir Com